2013年全球药物研发的一些新的趋势

2013-07-05 MedSci MedSci原创

在过去被称为失去的十年中,全球制药业的研发产品线并不理想。近年来有哪些趋势呢?William Looney给您进行如下解释。作者主要介绍了包括以下一些研究热点领域:老年性痴呆,丙肝药物,类风湿性关节炎,肿瘤,高血脂,糖尿病,多发性硬化,骨质疏松,以及一些孤儿药的开发状况。

在过去被称为失去的十年中,全球制药业的研发产品线并不理想。近年来有哪些趋势呢?William Looney给您进行如下解释。作者主要介绍了包括以下一些研究热点领域:老年性痴呆,丙肝药物,类风湿性关节炎,肿瘤,高血脂,糖尿病,多发性硬化,骨质疏松,以及一些孤儿药的开发状况。

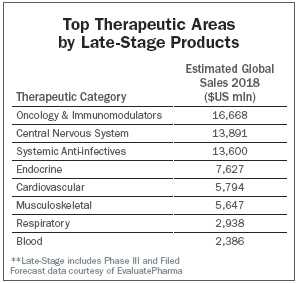

Is the "lost decade" of declining pipeline productivity finally over? Our annual survey of analyst assessments of the state of drug development suggests so, with subtle shards of sunlight beginning to penetrate the gloom cast by the historic loss of exclusivity on more than $80 billion of blockbuster medicines since 2009, as well as the unexpected challenges in leveraging the promise of the human genome through the application of molecular biology to drug treatment.

Our discussions with a baker's dozen of investment analysts and experts provided insights that lead us to three strategic conclusions about new drug prospects for the year ahead. First, the demand from payers and patients for better evidence of outcomes has imposed new discipline on the R&D process, which is bearing fruit—our list of promising compounds clearly shows an improved correlation between development priorities and areas of real unmet medical need. Second, the emergence of biologics as the dominant area of focus suggests that the process of drug development has finally caught up with the science unleashed by the genomics revolution. Third, the commercial potential of many of these compounds are cited sufficiently to lead us to conclude that predictions of an end to the blockbuster era of "billion dollar plus" medicines are premature.

It all goes back to the traditional premise that if the clinical need is there, revenues will follow. The big overhang is whether those revenues will be accompanied by the high profit margins required to defray an equally high level of exposure risk. The irony is that, even with the resolution of the so-called crisis in R&D and a return to a more productive pipeline, the industry must still confront a gradual but irrevocable erosion of control over access and pricing for these "next generation" products.

—William Looney, Editor-in-Chief

Alzheimer's Disease: Moving Forward

|

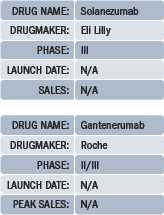

Many disheartened onlookers assumed that Eli Lilly's solanezumab, a similar compound also targeting beta amyloid, was destined for the same fate. While solanezumab is not the game-changer in Alzheimer's that everyone is still waiting for, Lilly's Phase III EXPEDITION trial did evince a slowing of cognitive decline among patients in early stages of the disease. Whether or not solanezumab will eventually receive approval—and there are plenty of opinions in support of both answers to that question—what's more important is that companies working in Alzheimer's can now optimize their own development programs around Lilly's results.

"There's a difference between the fact that it got the scientists and clinicians very excited, and the fact that it's not going to be approved and be a revenue generator for Lilly," says Ben Weintraub, senior principal and director of research at inThought, a division of Source Healthcare Analytics. "The results were statistically significant but not clinically significant. But the fact that it had any effect [on cognitive decline] at all—this is the first drug that showed any hint of doing anything—is very exciting." In a note to investors, Tim Anderson of Bernstein Research described the solanezumab "controversy" as one related to Lilly's "out of favor stock among the majority of sell-side analysts," in that "bears will likely continue to find reasons to be bears, and bulls will likely continue to remain bulls until more definitive data on solanezumab is generated."

Anderson, as of late October, put solanezumab's chances of eventual approval at about 40 percent. Seamus Fernandez, of Leerink Swann, gave solanezumab a 30 percent to 50 percent chance of earning $5 billion in sales in 2022, "despite evidence giving a modest signal of cognitive benefit at 18 months."

|

Les Funtleyder |

Hepatitis C: The More the Merrier

|

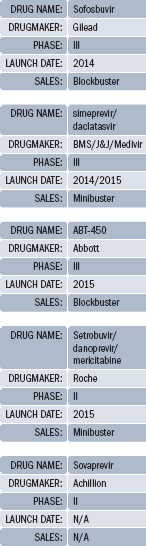

Now that development of the Bristol-Myers Squibb/Inhibitex NUC compound has been halted due to cardiovascular side effect issues (resulting in a $1.8 billion BMS write-off in the third quarter), and Idenix Pharmaceuticals' lead NUC put on hold a second time by FDA over safety concerns, the only NUC left standing is Gilead's sofosbuvir (GS-7977), a Phase III drug obtained through Gilead's recent $10.8 billion acquisition of Pharmasset. Sofosbuvir stands tall, and tops several forecast lists—assuming it gets approved—with peak sales estimated at $2 billion in 2018 (Adis Insight), $4.5 billion in 2017 (Thomson Reuters Cortellis), and a whopping $5.8 billion in 2018 (EvaluatePharma). These numbers anticipate the promise of the NUC class as an interferon-free treatment, which could also be achieved through a spate of emerging non-NUC products and combinations.

Bristol-Myers Squibb/J&J/Medivir's protease inhibitor simeprevir is currently being tested in combination with Bristol's daclatasvir, an NS5A inhibitor, and could potentially launch in 2014 without interferon. Abbott's ABT-450, an oral NS34A inhibitor, is being tested in Phase III combination trials with other Abbott compounds plus ribavirin, with a target approval date in 2015. ABT-450 posted strong initial data from a Phase IIb trial (AVIATOR), with a full data read-out scheduled for the American Association for the Study of Liver Diseases (AASLD) in Boston this November. Adis Insight predicts blockbuster sales for ABT-450 by 2019.

Roche continues its focus on non-NUCs, namely setrobuvir, danoprevir, and mericitabine, and several combinations thereof. All three remain in Phase II at the moment. Aegis Capital's Selvaraju is bullish on a fast-tracked Achillion Pharmaceuticals protease inhibitor called sovaprevir, currently in Phase II, which he says has "significant advantages" over orally bioavailable classmates including denoprovir, Vertex's Incivek, simeprevir, and ABT-450. Achillion is the company to watch at the upcoming AASLD meeting, predicts Selvaraju. "I think the long-term future is going to be some combination of GS-7977, ABT-450, Roche's denoprovir, and Achillion's sovaprevir. These cocktails will render their forefathers—like Incivek and Merck's Victrelis—completely irrelevant," he says.

"The interesting thing about hepatitis C is that it's a virus infection so prone to mutation that we need to build up a big armory of treatments, so that when a patient becomes refractory to one, they've got something else to move on to," says Kiran Meekings, a consultant at Thomson Reuters Life Sciences in London. "People are rightly focusing on drug combinations, which are likely to be the best pathway to resistance."

"I think within five years we will have an all oral, interferon free hepatitis C regimen that works at least in some of the mutations," says Funtleyder. "That's a big deal in the United States, and to a lesser degree in Western Europe. But in Asia, where patients really need new hepatitis C products, these new combinations will find challenges to uptake due to their high costs."

Rheumatoid Arthritis: Return of the DMARDs

|

|

Michael Latwis |

Data from the largest of the Phase II studies is expected in November, which, if positive, means "we can legitimately consider a potentially best-in-class among the orals," says Selvaraju. Incyte and Lilly are co-developing baricitinib, also an oral JAK inhibitor in Phase II. Selvaraju says all efficacies being equal, the Galapagos drug "is much safer than tofacitinib, and much safer than [baricitinib], because it's specific to a certain subtype of the Janus kinase. That is why Abbott went after it with such alacrity." With an estimated approval date set for January 2017, GLPG 0634 almost certainly won't be the first oral JAK inhibitor to market in RA, but then, Humira wasn't the first anti-TNF to market, either.

Bucking the oral JAK inhibitor trend in RA is Rigel Pharmaceuticals and AstraZeneca's fostamatinib, an oral Syk kinase inhibitor, currently in Phase III. Michael Latwis, at Decision Resources, predicts that fosamatinib will launch in 2015, and bring in $450 million in sales by 2018. Adis Insight has it doing slightly better, with sales close to half a billion in 2016, and $651 million in 2018.

Cancer: Improving on Innovation

|

Roche recently announced a Phase III trial—not yet enrolled—that would evaluate a combination of Zelboraf and GDC-0973, the latter a small molecule MEK inhibitor originating from Exelixis's kinase inhibitor research program. GSK is also getting into malignant melanoma with a BRAF inhibitor akin to Zelboraf called dabrafenib, which employs a companion diagnostic developed in concert with the French company bioMerieux SA. Dabrafenib is also being tested in combination with a MEK inhibitor, GSK/Japan Tobacco's trametinib. Both dabrafenib and trametinib are in preregistration as monotherapies in the United States and Europe, and GSK is conducting Phase III trials on the combination. Both of the GSK drugs reported positive data at ASCO this year, says Tatiana Spicakova, a consultant at Kantar Health. "For so long there was nothing for melanoma patients, and that has changed dramatically in the last couple of years. And now, with the BRAF/MEK inhibitor, combination products are supposed to be more efficacious and actually safer than the monotherapies."

The National Cancer Institute estimates that 76,250 new cases of melanoma will be diagnosed in the United States this year, and almost 10,000 patients will die from the disease. Yervoy, a monoclonal antibody and CTLA-4 inhibitor, only works in about one in four patients, but it works well in those patients. Zelboraf is faster acting and has excellent response rates due to its companion diagnostic, but only around half of the patient population carries the BRAF mutation.

BMS's nivolumab, a PD-1 inhibiting monoclonal antibody, is being tested for malignant melanoma (Phase II in Japan), renal cancer, and, surprisingly, non-small cell lung cancer, among other cancers and other diseases. Despite early phases of development, Stephanie Hawthorne, director at Kantar Health, and Spicakova say nivolumab could be huge, given its apparent range of activity. "Renal cell carcinoma and melanoma are smaller populations, but the lung cancer population is huge," says Hawthorne. Responses to nivolumab in non-small cell lung cancer, presented at ASCO this year, "were a big surprise to everyone because lung cancer is not usually thought of as a particularly immunogenic tumor," says Spicakova. "And it's supposed to have a better safety profile than Yervoy."

Thomson Reuters, Decision Resources, and Kantar Health are all predicting blockbuster sales for trastuzumab emtansine, also known as T-DM1—but better known as Roche's next generation Herceptin. It is in preregistration as a second-line therapy (behind Herceptin) for breast cancer. Backed by two Dako-developed companion diagnostics, next-gen Herceptin also targets the HER2 population, but adds ImmunoGen's anti-mitotic agent DM1 to create an antibody drug conjugate that links with a cytotoxic (e.g., chemotherapy) treatment. In Phase III studies, Roche is pitting T-DM1 head-to-head against it's own Xeloda plus GSK's Tykerb in second line treatment, and against Herceptin and Perjeta in the first-line, metastatic breast cancer setting. Given the success of Herceptin, which earned over $5 billion last year, "Roche is being very cautious about how to position these drugs relative to each other, because TDM-1 could very well cannibalize Herceptin' sales," says Hawthorne. Upon receiving approval in second-line treatment, Roche is expected to go after a first-line indication next, which "is the ultimate goal," says Thompson Reuters' Meekings. In the European Union, Herceptin's patent could expire in 2014, but is expected to hold out in the United States until 2018 or 2019.

In prostate cancer, a perennial area of interest for investors and analysts, the Norwegian biotech Algeta and partner Bayer are developing a Phase III radium-223 chloride product to be called Alpharadin in Europe, and Xofigo in the United States. Featuring a completely new mechanism of action, radium-223 employs a radioactive isotope that acts as a calcium mimic to target bone metastases without affecting normal bone marrow. Algeta is testing the drug in patients with metastatic hormone refractory prostate cancer (fast-tracked in the United States), and Bayer has initiated expanded access programs in the United States, Canada, Europe and Israel. Since roughly 70 percent to 95 percent of prostate cancer patients get bone metastasis, in addition to 75 percent of breast cancer patients and 40 percent of lung cancer patients, this product could cover a lot of ground. "Algeta leadership has said they believe they'll get 85 percent of the global prostate market, which is massive" all by itself, says Meekings. Radium 223 chloride has shown a significant improvement to overall survival—the gold standard of cancer drug endpoints—in hormone refractory prostate cancer patients.

|

In hematological cancers, Ariad Pharmaceuticals' ponatinib is awaiting approval in the United States and Europe for acute lymphoblastic leukemia (ALL) and chronic myeloid leukemia (CML), and could earn over $800 million by 2018, according to Latwis at Decision Resources. Celgene's pomalidomide, for multiple myeloma, is preregistered in the United States and Europe, and has a PDUFA date coming up in February 2013. Howard Liang, managing director, biotechnology at Leerink Swann, expects pomalidomide to gain approval and be "highly profitable" for Celgene, due to its sales synergy with Revlimid. Pharmacyclics and Janssen Biotech's orphan drug ibrutinib, a novel Bruton's tyrosine kinase (Btk) inhibitor for chronic lymphocytic leukemia (CLL), is in Phase III, and could reach blockbuster status by 2017, according to a Thompson Reuters estimate.

Hyperlipidemia: CETP Inhibitors, PCSK9 Inhibitors, and More

|

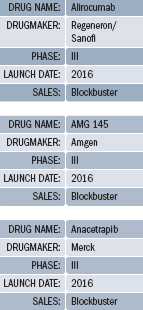

Merck is still working on its CETP inhibitor anacetrapib, but the excitement over this class of drugs has cooled, given the need for extremely robust data proving efficacy and safety. Given that, Meekings at Thomson Reuters says anacetrapib could still become a blockbuster several times over, but "it probably won't get approved before 2016." Lilly commenced Phase III trials on its CETP inhibitor, evacetrapib, but it's behind Merck's drug and faces the same challenges.

In the meantime, a new class of monoclonal antibodies targeting Proprotein Convertase Subtilisin/Kexin type 9 and known as PCSK9 inhibitors are entering later stages of development. The first of these, Regeneron/Sanofi's alirocumab, has recently entered Phase III trials for hypercholesterolemia, or very high cholesterol levels in the blood. Administered subcutaneously, alirocumab showed extremely good results in Phase II, and is already getting blockbuster whispers, according to Meekings.

A second PCSK9 inhibitor, Amgen's AMG 145, has also entered Phase III development. Like alirocumab, AMG 145 is being tested with and without a statin, and for familial hypercholesterolemia in addition to general hypercholesterolemia. Adis Insight predicts a January 2016 target approval date for both drugs, but gives AMG 145 a slightly higher chance of approval. "It remains to be seen which drug will emerge as the dominant PCSK9," says Meekings. Thompson Reuters expects peak sales for both drugs to reach $4 billion.

Orphan alert: mipomersen

Last year's orphan alert in the cholesterol space went to Aegerion Pharmaceuticals' lomitapide, which received a 13 to two vote for approval from FDA's Endocrinologic and Metabolic Drugs Advisory Committee on October 17. A day later, the same committee voted nine to six to approve Genzyme/Isis Pharmaceuticals' mipomersen (brand name Kynamro), an oligonucleotide antisense inhibitor for the treatment of familial hypercholesterolemia. Analysts have been bullish on lomitapide for some time, and it's expected to earn nearly half a billion dollars in annual sales. While the two drugs would compete in the familial orphan indication, Sanofi/Isis, unlike Aegerion, is following the orphan indication with Phase III trials for hypercholesterolemia in patients at risk for coronary heart disease, a decidedly un-orphan indication. "It will be interesting to see how mipomersen pivots into the non-familial indication," says Meekings. More specifically, it will be interesting to see how Sanofi/Isis handles the inevitable pricing issues that will arise as a result of crossing over from orphan to non-orphan indications.

Diabetes: Incremental Improvement

|

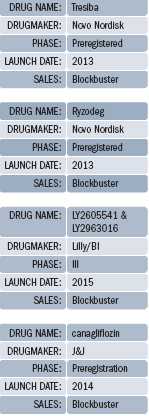

Novo Nordisk has suggested that their degludec products show an added benefit over Lantus in the form of fewer instances of hypoglycemia, or dangerously low blood sugar levels. Sanofi has rebuffed that suggestion, claiming that Novo "unfairly stacked the deck against [Sanofi] in the design of their clinical trials," wrote Tim Anderson of Bernstein Research in a note to investors. FDA announced that it would convene a committee meeting to discuss cardiovascular risks associated with Novo's two degludec products, and also to discuss the merits and potential benefits surrounding the hypoglycemia-related benefit claims. "As only a few of the degludec clinical trials have been published in full, it is difficult to determine how strong the cardiovascular 'signal' with degludec is," wrote Anderson. Lantus is expected to earn over $6 billion in global sales this year—11 percent of Sanofi's total companywide sales—so what Novo can and can't claim if Tresiba and Ryzodeg receive approval will matter a lot to Sanofi. There isn't much of a distinction between these new products and Lantus, in terms of meaningful efficacy or product attributes, so marketing prowess around the world is an outsized factor in gaining or losing market share in the straight insulin game. "In emerging markets, Novo Nordisk has an indisputable edge," notes Selvaraju. "Particularly in China, no one can challenge Novo Nordisk in the diabetes space."

Lilly and Boehringer Ingelheim hope to pitch their own jointly-developed versions of long-acting insulin—LY2605541 and LY2963016—into the mix. Phase III trials taking on Lantus head-to-head are currently underway in both type 1 and type 2 patients. Reports from one such study suggested comparable efficacy, but indicated a weight loss benefit with Lilly/Boehringer's LY2605541. If that benefit holds through additional trials, it could provide a significant advantage over competing therapies.

Beyond pure insulin therapies, J&J's SGLT2 canagliflozin continues to amass mostly positive data, including a Phase III trial that showed the compound outperforming Merck's type 2 blockbuster drug Januvia. Studies also indicate a slight weight loss benefit with canagliflozin, but if history is any guide, FDA will be meticulous—to put it mildly—in scrutinizing the drug's safety profile before making a decision. If approved, Canagliflozin would be first SGLT2 to market; BMS/AstraZeneca's SGLT2, dapagliflozin, had been leading the way, but got pulled out of line after FDA issued a complete response letter requiring more safety data. European regulators haven't shown as much concern over dapagliflozin; the EMA recommended approval last April. Sales of canagliflozin, if approved, will hit $1.2 billion by 2015, according to Adis Insight.

Despite a crowded landscape—if an SGLT2 is approved, it will face off against GLP-1s like Novo's Victoza and Amylin/Alkermes Bydureon, and DPP4s like Merck's Januvia, BMS/AZ's Onglyza and Lilly/Boehringer Ingelheim's Tradjenta—there's room to grow, with the market for type 2 diabetes drugs nearly doubling, from $26 billion in 2011 to $50 billion in 2022, according to Decision Resources.

Multiple Sclerosis: We've Got Your Number

|

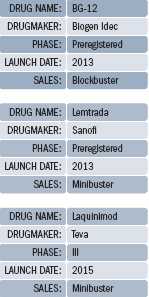

The next big thing in MS, according to everyone who has an opinion on the matter, is Biogen Idec's BG-12, one of the most hyped products in any category. On track to receive approval this year, BG-12 had a PDUFA date of December 28 up until mid-October, when FDA announced that it needed more time to evaluate the drug's application. The agency didn't request additional studies, and Biogen CEO George Scangos, on a 3Q earnings call a few days after the announcement, didn't seem overly concerned. "While this three-month delay is disappointing, our view of the potential of BG-12 to benefit patients with MS has not changed," said Scangos on the call. Pivotal data published recently in the New England Journal of Medicine "form the foundation of our regulatory filings, and support BG-12's potential as a new oral option for MS treatment," he said.

|

Genzyme and Sanofi are dedicated to MS, but many believe Biogen Idec will dominate the category, at least in the near term. "If you look at all that has happened over the course of the last three of four years in MS R&D, the inescapable conclusion is that Biogen Idec is the 800-pound gorilla in the space," says Selvaraju. "They have a symptomatic therapy that they market outside the United States, they have two monoclonal antibodies, both of which have performed well in mid-to-late stage studies"—daclizumab and ocrelizumab—"they have a best-in-class oral therapy in BG-12, and they have one of the older generation injectable drugs, Avonex, in addition to Tysabri."

Note: In 2010, Genentech and Biogen Idec amended their antibodies deal and agreed that Genentech would take on full responsibility for the development of ocrelizumab. As stated in the agreement, Genentech assumed development and commercialization costs supporting ocrelizumab, and Biogen, if the drug is approved, is entitled to tiered, double-digit royalties on any US sales.

In May, Teva's CEO Shlomo Yanai announced that he would step down as the company's CEO, due in part to investor concern over the upcoming patent expiry of Copaxone in 2015, one of the company's few branded drugs. Copaxone earned over $3.5 billion in 2011, and represents a fifth of the company's total sales. Jeremy Levin, a former BMS executive and Teva's new CEO, said in a recent interview that any generic form of Copaxone would require extensive clinical trials to prove equivalency, according to a Financial Times report. In August, Teva received approval to conduct a Phase III trial in the United States on laquinimod—a once-daily immunomodulatory compound—for relapsing-remitting MS, under a Special Protocol Assessment. The trial, called CONCERTO, will evaluate two doses of laquinimod in approximately 1,800 patients for up to two years. The primary outcome measure will be confirmed disability progression, as measured by the Expanded Disability Status Scale.

Laquinimod "is the safest oral therapy" in development, per Selvaraju, but it failed to meet its primary endpoint of reducing annualized relapse rates versus placebo during a pivotal Phase III trial in 2011. Still, Selvaraju says laquinimod "may have an impact in terms of preserving brain tissue, or enhancing endogenous regeneration," in which case the drug may yet prove saleable.

Lightning Round: Orphans,Ophthalmology, Osteoporosis, and Others

|

» Merck's odanacatib, in Phase III trials for postmenopausal osteoporosis and male osteoporosis. "I like the early and mid-stage clinical data" supporting odanacatib, says Funtleyder. "Osteoporosis isn't the most glamorous disease, but a lot of people have it, and bisphosphonates aren't exactly the perfect cure." Several independent forecasts are predicting blockbuster sales for odanacatib, with an estimated approval date in early 2014.

» Sarepta Therapeutics' eteplirsen, a fast-tracked orphan drug indicated for Duchenne muscular dystrophy (DMD). Some analysts, including Selvaraju, suspect that orphan drug companies are reaching a point of unwarranted enthusiasm, as evidenced by relatively large market caps; Sarepta (formerly known as AVI BioPharma) sports a $1 billion valuation, "based on Phase II data from 12 people," he notes. But there's no treatment currently for DMD, and history has shown that the pricing environment for orphan drugs is exceedingly favorable for drug companies, a necessary incentive, some argue, for active drug development in rare disease categories.

» Lundbeck's vortioxetine, for major depressive disorder. Takeda has rights in the United States and Japan, and the drug is "classified as an SSRI, but has a slightly differently mechanism," says Latwis of Decision Resources. Vortioxetine is filed in the United States and Europe, and "we have it launching in late 2013, and reaching $1.1 billion by 2018," says Latwis. (See Pharm Exec's October cover story on Lundbeck.)

» Advanced Cell Technology's (ACT) human embryonic stem cell-derived retinal pigment epithelium cells for macular degeneration. While only in Phase I/II, ACT "has demonstrated the ability, with a very small volume injection of their stem cells, to regenerate not only retinal epithelium tissue, but also functional photo receptors," says Selvaraju. (See Pharm Exec's stem cell feature, also in the October issue, for further detail.)

» Actelion's macitentan, an orphan drug filed in the United States for pulmonary hypertension (PAH), and a follow-on to Actelion's blockbuster PAH drug Tracleer. Macitentan is a once-daily formulation, whereas Tracleer is administered twice daily. Decision Resources predicts an approval and launch late next year, with sales hitting $1.2 billion by 2018. Thompson Reuters puts 2017 sales at $990 million.

» Vertex's VX-809/Kalydeco combination, for cystic fibrosis. Last January, Vertex received approval for Kalydeco (ivacaftor) three months before its PDUFA date, and is now testing a fast-tracked combination of VX-809 (lumacaftor) and ivacaftor. VX-809 was discovered as part of aresearch collaboration with Cystic Fibrosis Foundation Therapeutics. Adis Insight predicts an approval date in January 2016, and blockbuster sales two years later.

Forecasting data in Pharm Exec's 2013 Pipeline Report relies in part on Springer's Adis R&D Insight, Thomson Reuters Cortellis, and EvaluatePharma data. We very much appreciate the use of these resources.

本网站所有内容来源注明为“梅斯医学”或“MedSci原创”的文字、图片和音视频资料,版权均属于梅斯医学所有。非经授权,任何媒体、网站或个人不得转载,授权转载时须注明来源为“梅斯医学”。其它来源的文章系转载文章,或“梅斯号”自媒体发布的文章,仅系出于传递更多信息之目的,本站仅负责审核内容合规,其内容不代表本站立场,本站不负责内容的准确性和版权。如果存在侵权、或不希望被转载的媒体或个人可与我们联系,我们将立即进行删除处理。

在此留言

#研发#

70

#药物研发#

65